All Categories

Featured

Table of Contents

This offers the policy proprietor reward options. Returns choices in the context of life insurance policy refer to just how policyholders can pick to make use of the rewards generated by their whole life insurance policy policies. Returns are not assured, nevertheless, Canada Life for instance, which is the earliest life insurance policy company in Canada, has not missed out on a returns settlement considering that they first established an entire life plan in the 1830's before Canada was even a nation! Here are the typical dividend alternatives available:: With this alternative, the policyholder makes use of the rewards to purchase added paid-up life insurance protection.

This is just recommended in the event where the death advantage is very essential to the policy proprietor. The added price of insurance policy for the enhanced coverage will lower the money worth, hence not excellent under limitless banking where cash money worth dictates just how much one can borrow. It is necessary to note that the availability of returns alternatives may differ relying on the insurance provider and the particular policy.

Although there are wonderful advantages for unlimited banking, there are some points that you should think about before obtaining into infinite banking. There are additionally some disadvantages to infinite banking and it might not be appropriate for somebody that is seeking budget friendly term life insurance policy, or if somebody is checking into buying life insurance policy solely to protect their household in the occasion of their death.

It is essential to recognize both the advantages and limitations of this monetary approach prior to determining if it's appropriate for you. Complexity: Unlimited financial can be complex, and it is very important to comprehend the details of how an entire life insurance policy jobs and just how policy loans are structured. It is necessary to properly set-up the life insurance policy policy to enhance infinite financial to its full potential.

Who can help me set up Infinite Banking Vs Traditional Banking?

This can be especially bothersome for individuals that depend on the survivor benefit to offer for their enjoyed ones (Infinite Banking). Generally, boundless banking can be a beneficial monetary technique for those that recognize the details of just how it works and agree to accept the prices and restrictions connected with this investment

The majority of firms have 2 various types of Whole Life plans. Over the program of numerous years, you contribute a significant amount of money to the plan to construct up the cash value.

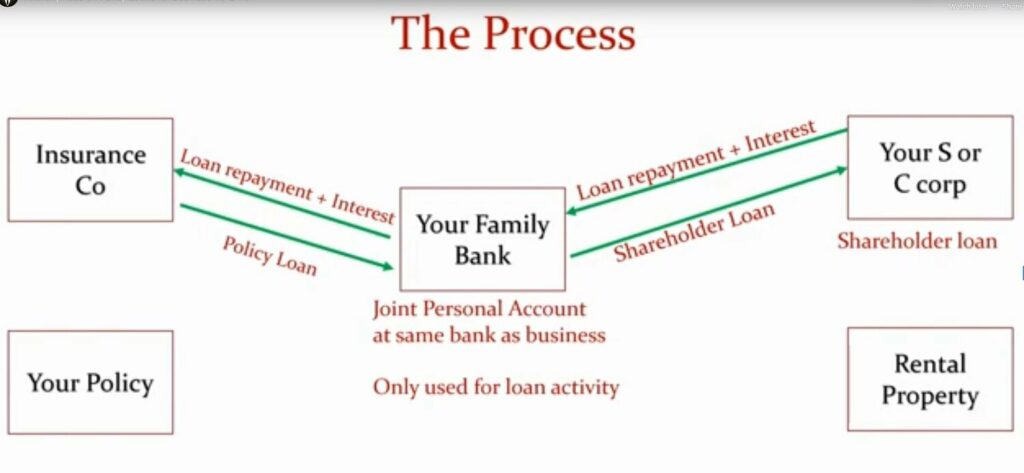

You're essentially lending cash to yourself, and you repay the loan over time, frequently with interest. As you repay the car loan, the cash money worth of the policy is restored, enabling you to obtain against it once more in the future. Upon fatality, the fatality benefit is decreased by any exceptional fundings, but any continuing to be survivor benefit is paid out tax-free to the beneficiaries.

How flexible is Infinite Banking For Retirement compared to traditional banking?

Time Perspective Threat: If the insurance holder makes a decision to cancel the policy early, the money abandonment worths might be significantly lower than later years of the policy. It is suggested that when discovering this plan that one has a mid to lengthy term time perspective. Tax: The insurance holder may sustain tax consequences on the financings, returns, and survivor benefit settlements got from the plan.

Intricacy: Infinite financial can be complex, and it is essential to understand the information of the plan and the cash money build-up element prior to making any type of investment decisions. Infinite Banking in Canada is a legit monetary technique, not a fraud. Infinite Financial is an idea that was developed by Nelson Nash in the USA, and it has given that been adapted and implemented by monetary specialists in Canada and other nations.

Plan fundings or withdrawals that do not surpass the adjusted price basis of the policy are thought about to be tax-free. However, if plan loans or withdrawals exceed the adjusted price basis, the excess amount may undergo taxes. It is essential to note that the tax obligation advantages of Infinite Financial might undergo alter based on changes to tax obligation laws and policies in Canada.

The risks of Infinite Banking include the possibility for policy finances to lower the death benefit of the policy and the opportunity that the policy might not perform as anticipated. Infinite Financial might not be the very best technique for everybody. It is vital to thoroughly take into consideration the costs and potential returns of participating in an Infinite Banking program, in addition to to completely research study and recognize the affiliated dangers.

How flexible is Wealth Building With Infinite Banking compared to traditional banking?

Infinite Banking is various from traditional financial in that it permits the insurance policy holder to be their own source of financing, as opposed to depending on standard financial institutions or lending institutions. The insurance policy holder can access the cash money value of the policy and use it to finance acquisitions or investments, without needing to go through a conventional loan provider.

When a lot of people need a funding, they apply for a line of credit through a traditional financial institution and pay that car loan back, over time, with interest. For doctors and various other high-income income earners, this is possible to do with unlimited banking.

Below's a monetary advisor's review of unlimited banking and all the advantages and disadvantages entailed. Limitless banking is a personal banking technique created by R. Nelson Nash. In his publication Becoming Your Own Lender, Nash clarifies just how you can utilize a permanent life insurance coverage plan that builds money value and pays returns thus freeing on your own from needing to borrow money from lenders and repay high-interest lendings.

Is Infinite Banking Wealth Strategy a better option than saving accounts?

And while not every person is on board with the idea, it has tested numerous countless individuals to reassess exactly how they financial institution and exactly how they take car loans. Between 2000 and 2008, Nash released six editions of the publication. To now, monetary consultants contemplate, technique, and discuss the idea of infinite financial.

The basis of the boundless financial idea begins with irreversible life insurance policy. Infinite banking is not possible with a term life insurance plan; you need to have a long-term money value life insurance policy.

Yet with a dividend-paying life insurance policy policy, you can grow your money worth also quicker. Something that makes entire life insurance policy special is earning even more money with dividends. Mean you have an irreversible life insurance policy plan with a common insurance firm. Because instance, you will be eligible to obtain part of the firm's profits similar to exactly how stockholders in the business get dividends.

Table of Contents

Latest Posts

Can I use Cash Value Leveraging for my business finances?

What are the common mistakes people make with Financial Independence Through Infinite Banking?

Bank On Yourself

More

Latest Posts

Can I use Cash Value Leveraging for my business finances?

What are the common mistakes people make with Financial Independence Through Infinite Banking?

Bank On Yourself